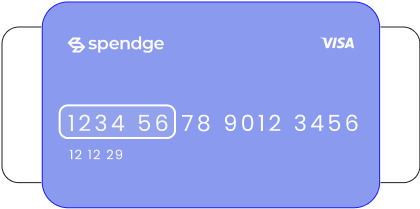

Who are Spendge personal crypto cards for?

We designed these cards for everyone who values flexibility, security, and global access to their funds:

- Freelancers and remote professionals who receive payments in cryptocurrency

- Users who value financial privacy

- Travelers and digital nomads who need cards with global coverage

- People who use cryptocurrency for everyday spending

- Anyone looking for a convenient and secure way to pay online and offline worldwide

You get a card that can be connected to Apple Pay / Google Pay and used like a regular one — but with the flexibility of crypto and the security of virtual cards.