Unique use cases from Spendge

-

Case 1: Paying large transactions

Problem:

Our client is a company that pays dozens of services to support its infrastructure: from advertising to flight tickets. Regular expenses include Google Ads, Meta, AWS, G Suite, Hetzner, OpenAI, Namecheap, and others. Cloudflare stands out in particular: monthly charges for this service exceed 200,000 EUR.

The client’s bank blocks amounts of this size, preventing such transactions from going through. As a result, payments fail and critical services experience disruptions.

Solution:

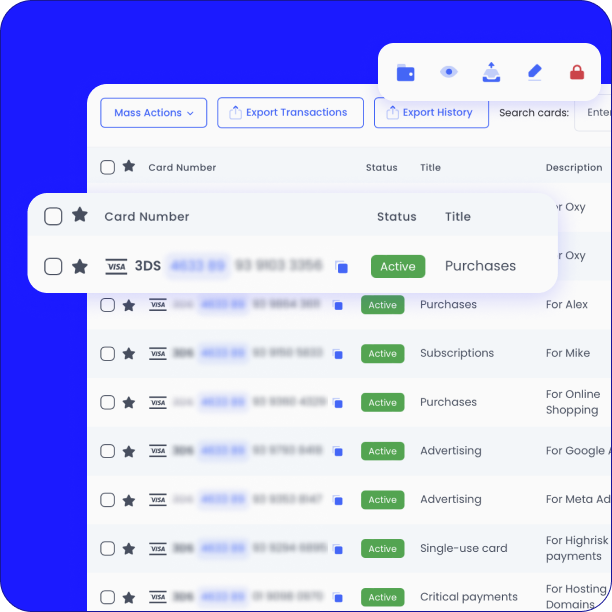

Spendge corporate cards allow payments of up to 500,000 EUR per single transaction. This enables the client to reliably pay for key services, while transaction exports have become the finance manager’s favorite tool.

-

Case 2: Financial manager autonomy

Problem:

The client company grew rapidly from 15 to 200 employees. The finance manager paid all subscriptions and services using a bank card linked to the company’s current account. All confirmations — SMS, OTP codes, notifications — were sent to the director’s phone. At any time, during negotiations or even at night, the team had to contact the director to pay for a ChatGPT subscription or purchase a domain.

Solution:

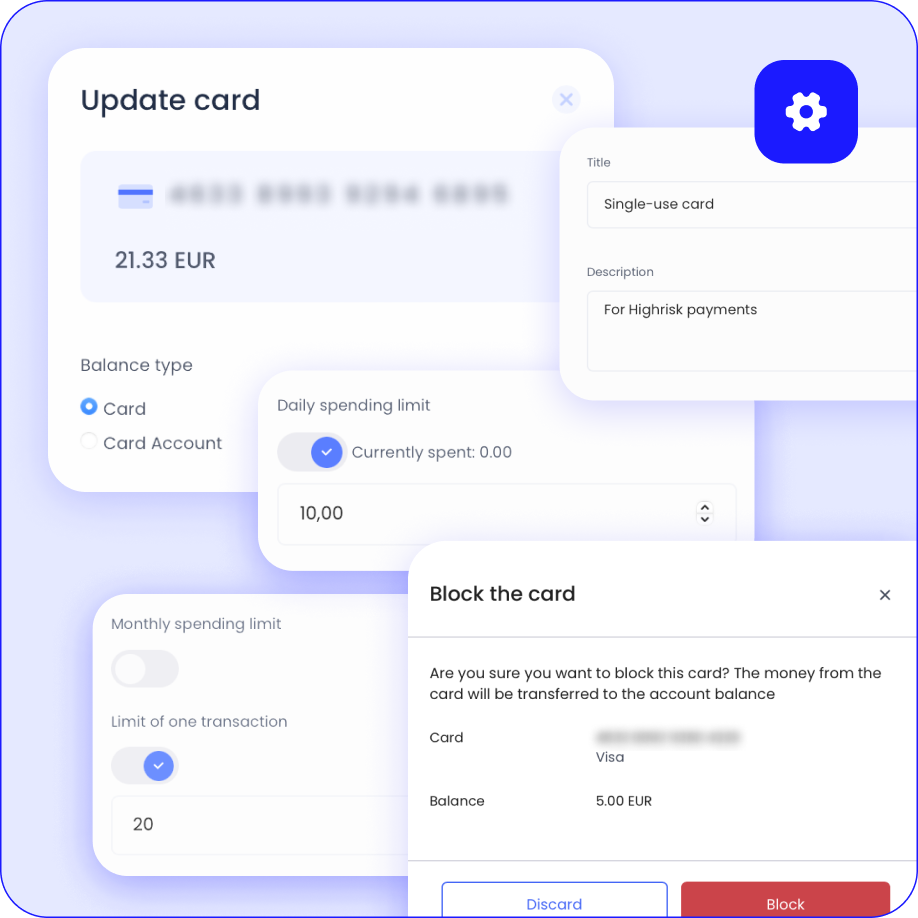

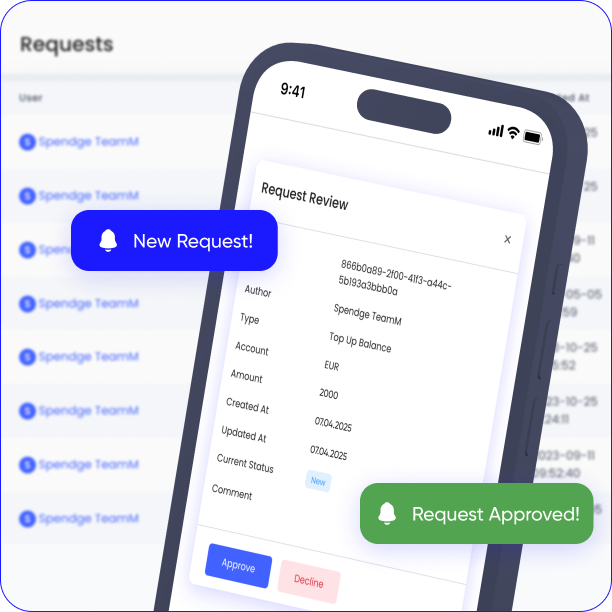

With Spendge, the finance manager independently issues cards, sets limits, and manages subscriptions. For higher-risk scenarios, cards with isolated balances are created — it is impossible to spend more than the amount available on the card. Financial processes run smoothly, and the director is no longer distracted by operational details, focusing instead on strategy.

-

Case 3: Reducing tax burden

Problem:

Most virtual cards funded with cryptocurrency do not allow expenses to be properly recorded in accounting, meaning such payments cannot be included in tax reporting.

Solution:

Spendge offers legal corporate cards funded via SEPA from a corporate account. All expenses made with these cards are recognized as official business expenses. Clients use them to pay for subscriptions, advertising, and other services, reducing tax burden while submitting complete and transparent expense reports.