Use cases for Spendge in media buying

-

Case 1: Google account farming – fewer bans, more stable launches

Problem:

A media buyer was farming Google Ads accounts at scale, but the accounts were regularly banned during warm-up or right after the first charges. The cards they used quickly lost trust with the platform, and some card link attempts failed entirely. As a result, the farming cycle kept breaking and the cost per account kept rising.

Solution:

They switched to Spendge and started farming on trusted BINs. After changing the payment foundation, linking became more consistent and early-stage bans dropped. They built a clear process: one account – one card, with limits and fast reissuing when needed, making farming more predictable and scalable.

-

Case 2: Taboola – card linking despite strict security rules

Problem:

A team was running traffic through Taboola and faced repeated card declines during the payment setup. Due to Taboola security settings, most virtual cards were rejected. Linking failed, and attempts with multiple providers wasted time and froze test budgets.

Solution:

With Spendge, the team successfully linked cards and started paying spend consistently. We helped them choose the right BIN and card setup for Taboola, after which payments went through without constant rejections or manual workarounds.

-

Case 3: Apple Developer – linking after multiple failed attempts

Problem:

A developer needed to pay for the Apple Developer account and tried different cards, but after a few successful links, new cards stopped working. They tested more than ten options with no result, which blocked publishing and updates.

Solution:

Our manager selected a BIN based on transaction history and payment success statistics for Apple Developer. The card linked successfully, and subsequent renewals and payments ran smoothly. The client restored their workflow and removed payment-related downtime risks.

-

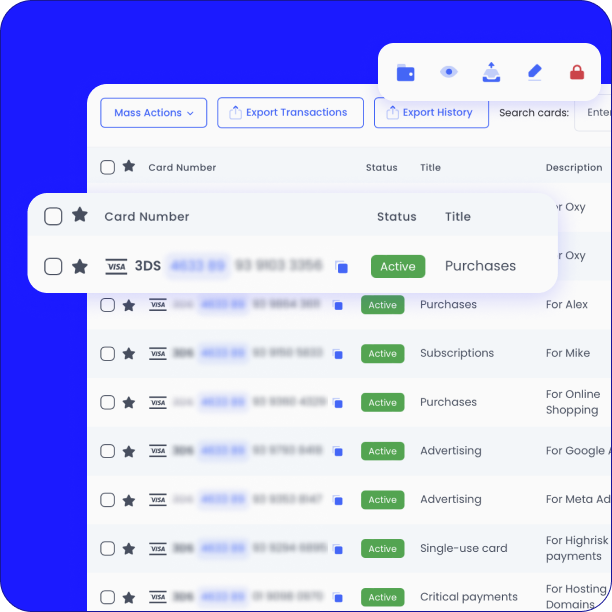

Case 4: Large media buying team – better discipline, stronger control, higher ROI

Problem:

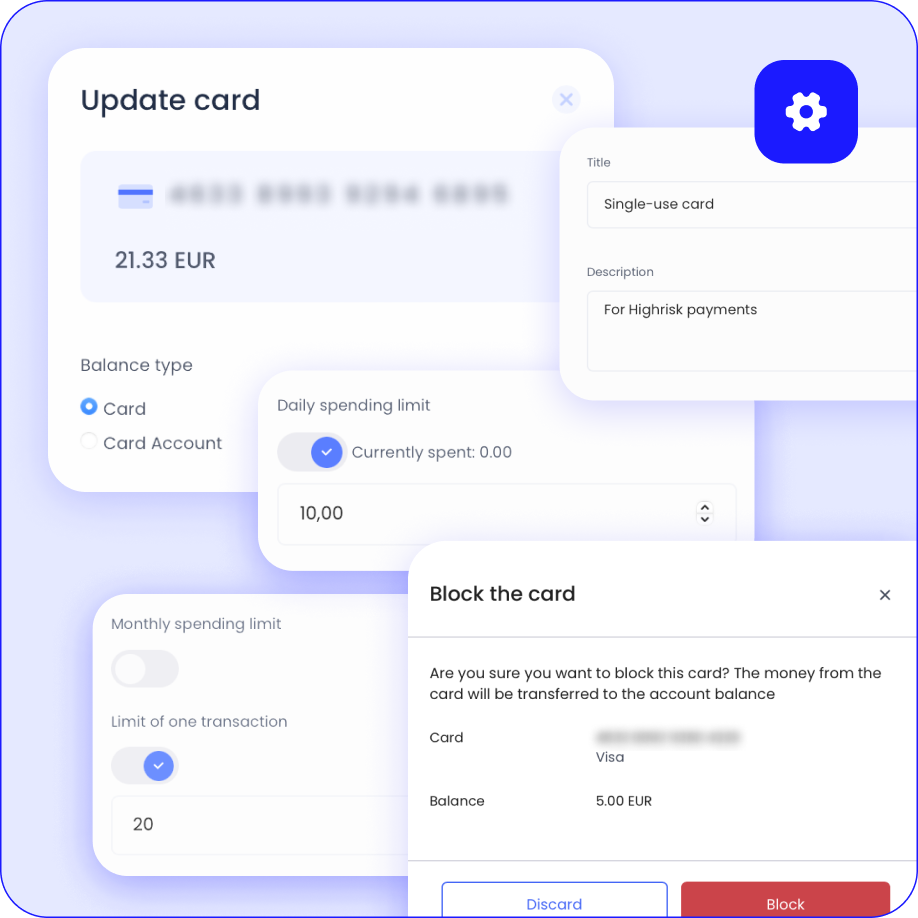

A large team struggled with financial discipline: budgets were mixed, cards were shared manually, reporting took too long, and spend tracking caused friction. This reduced control and made scaling harder.

Solution:

We enabled a Spendge team account: the admin allocated budgets across buyers and projects, and set limits and isolation. Financial control became transparent, discipline improved, and decision-making on budgets and tests became faster. As a result, the team increased overall ROI through better spend control and more efficient campaign management.