What are Spendge virtual cards?

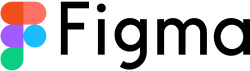

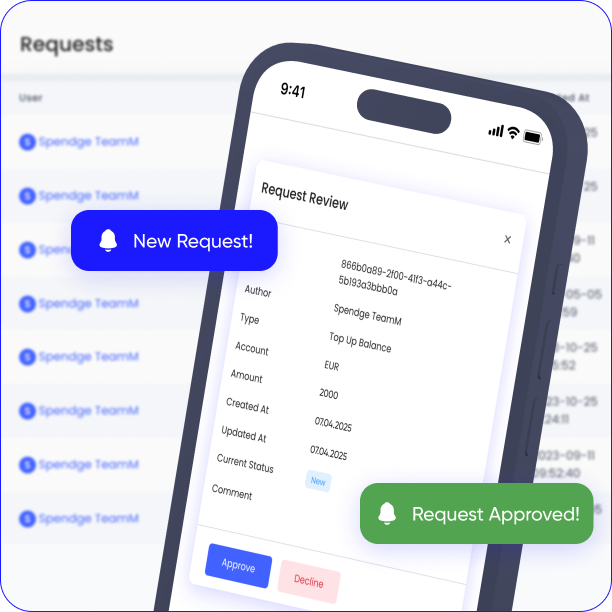

Spendge virtual cards are Visa/Mastercard cards you can issue in a few clicks and use to pay for ads, digital services, and everyday purchases. You get full spend control: create separate cards for different tasks, set limits, and manage balances in one dashboard.

What you can use them for:

- Pay for ads and traffic sources (Google Ads, Meta, TikTok, and more)

- Pay for subscriptions and digital services (SaaS, work tools, AI services)

- Separate budgets: one card per ad account, project, team, or client

- Improve payment security: dedicated cards for higher-risk payments and testing

- Control spending: per-transaction / daily / monthly limits and transparent analytics

Who they are for:

- Media buying teams and solo media buyers

- Affiliate and performance marketers, and digital agencies

- Internet entrepreneurs, freelancers, and webmasters

- Companies that need control over corporate expenses and subscriptions

- Individuals who want convenient online payments and privacy

- Any business with expenses